Inflation may negatively impact your finances. Inflation has been rising rapidly this year. Government stimulus, high consumer demand, COVID-19, and supply chain difficulties are contributing factors. It is critical not to overreact during these inflationary times. Returning to the basics and knowing what you’re spending your money on, having a long-term investment strategy, and considering methods to minimize your debt are the greatest approaches to counter increasing inflation. Inflation may make household budgeting more difficult.

Understanding how to prepare for it begins with examining your expenditures and debt, as well as possible improved income prospects. Savings objectives are the things you desire to accomplish in the future. Once you’ve set your goals, you can work out how to achieve them. You must first identify what you want to save. You’ll get there faster if you place your target. If you are new to saving, begin with a simple goal. Even if you’re only saving for a rainy day, having a goal amount in mind will increase your chances of success.

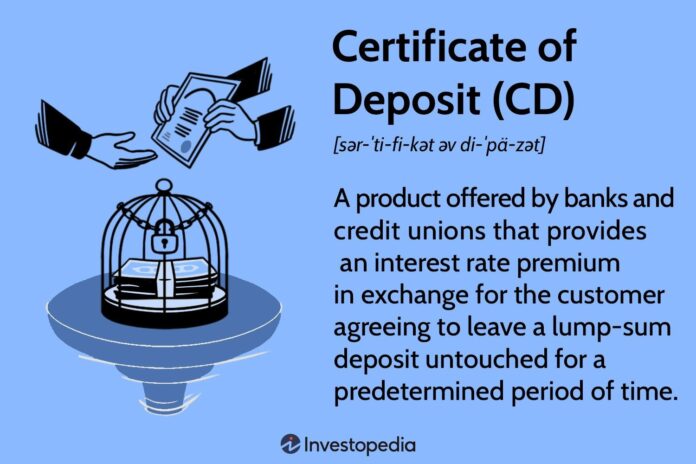

An interest-bearing savings account, known as a certificate of deposit (CD), retains a fixed sum of money for a specific time. You will get the amount you initially deposited plus any interest when you cash in or redeem your CD. One of the safest ways to save money is using certificates of deposit. When so many options exist, it might be challenging to decide which financial institutions to trust. Online bank Marcus by Goldman Sachs provides a savings account and several CD maturities.

Marcus is renowned for giving its savings products reasonable rates. The ever-expanding list of bank and credit union reviews on Bankrate is updated often. The Marcus CD rates are competitive with those of many other online banks. The variety of no-penalty CDs it offers gives customers who require access to their assets before maturity more choices.

Here are the three essential advantages of a Certificate of Deposit.

- Competitive interest rates

Competitive advantage is the company’s ability to produce goods or provide services better than its competitors. It enables a corporation to create wealth for itself and its shareholders by achieving more significant margins. A competitive advantage is anything unique to a firm or business that cannot be duplicated. Internally developed, this value sets the company apart from its rivals.

In finance, a competitive interest rate could equate to a lower monthly payment. Several factors influence this rate. The smaller the loan payment, the lower the interest rate. Banks frequently display interest rates online. It’s important to weigh your alternatives while selecting the finest. Competitive interest rates are essential for protecting borrowers from economic uncertainty, which is determined by several variables, including debt-to-income ratio, down payment, and credit score. You are more likely to receive a competitive interest rate the more favorable these characteristics are. In some circumstances, it makes more sense to pay an interest rate higher over time than it would be if it were lower.

- The balance requirements for CDs are relatively low.

When opening a certificate of deposit, almost every financial institution has a minimal starting amount requirement. Various banks have different minimum deposit requirements, although many banks provide CDs with no minimum balance requirements. It is customary to deposit at least the minimum sum needed to start an account when opening a certificate of deposit at a bank or credit union. The “minimum deposit” is this sum, and almost all banks have a minimum deposit requirement for creating a CD. Compared to other banks, Marcus’s CD opening requirements are relatively low.

Examining several possibilities is essential when choosing the finest loan. No specific regulations establish a minimum deposit amount for CDs; banks select their minimum requirements. The different banks may have other minimum deposit requirements. To fulfill the demands of their clients, several banks provide a range of CDs with various periods and yields. Some CDs could have unique features like an escalating rate, no withdrawal fees, or huge returns.

- The customer service line provides twenty-four hours of account access.

If you keep up with new customer service trends, you know that clients today want around-the-clock assistance. According to industry experts and recent research, failing to do so led to dissatisfied consumers and lost revenue, which is nearly guaranteed to happen when your firm grows and expands beyond its initial audiences and markets. Customers don’t care about standard business hours, especially if your organization is worldwide. Not all issues arise during business hours. Even while you know your business cannot operate around the clock, your customer support still needs to be included.

Putting a lot of emphasis on after-hours customer care is an intelligent approach to offering the service. Your customer assistance must be incorporated even though you are aware that your firm cannot run continuously. Putting a lot of emphasis on after-hours customer care assistance is a terrific approach to delivering the kind of service that customers value and will use repeatedly. Any company is capable of providing around-the-clock service.

Several companies offer business process outsourcing, and their highly skilled employees are ready to start working for you. To provide round-the-clock support, you must match your work hours to your clients’ assistance demands by utilizing a follow-the-sun support model with the current outsourcing alternatives, whether the communication is by email, chat, phone, or all of the above.